A Deeper Look at Kansas Weather Trends

The past several years, the insurance industry has been challenged with a market characterized by rising premiums, reductions in coverage, and fewer carrier options. There are many factors driving the changes, but none plays a bigger role than the impact of severe weather. To provide a deeper understanding of the impact that weather events are having on the marketplace and to aid in conversations with your customers, this article provides an overview of trends in Kansas.

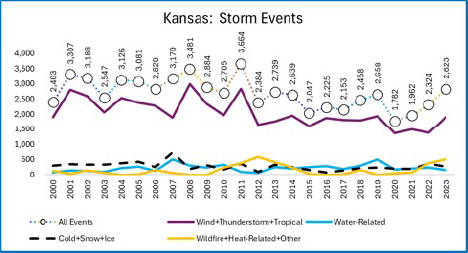

Rising Frequency of Weather Events

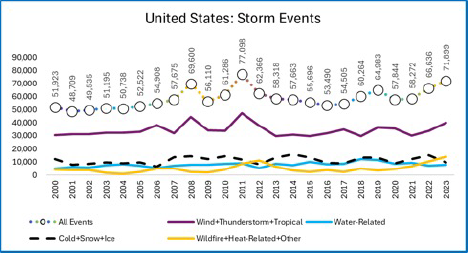

In 2023, Kansas had 2,823 storm events. This is the highest frequency of storm events since 2011, and 58% increase in events since 2020. On average, the state of Kansas has roughly twice the number of severe weather events as other states.

Kansas Wind is Always Blowing

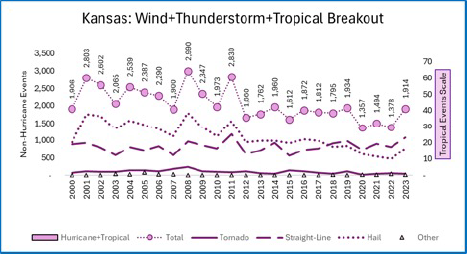

The most frequently seen storm events in Kansas involve tornados, funnel clouds, hail, high wind, thunderstorms, and lightning. In 2023, there were 1,914 of this category of storm events across Kansas which is the third most over the past ten years.

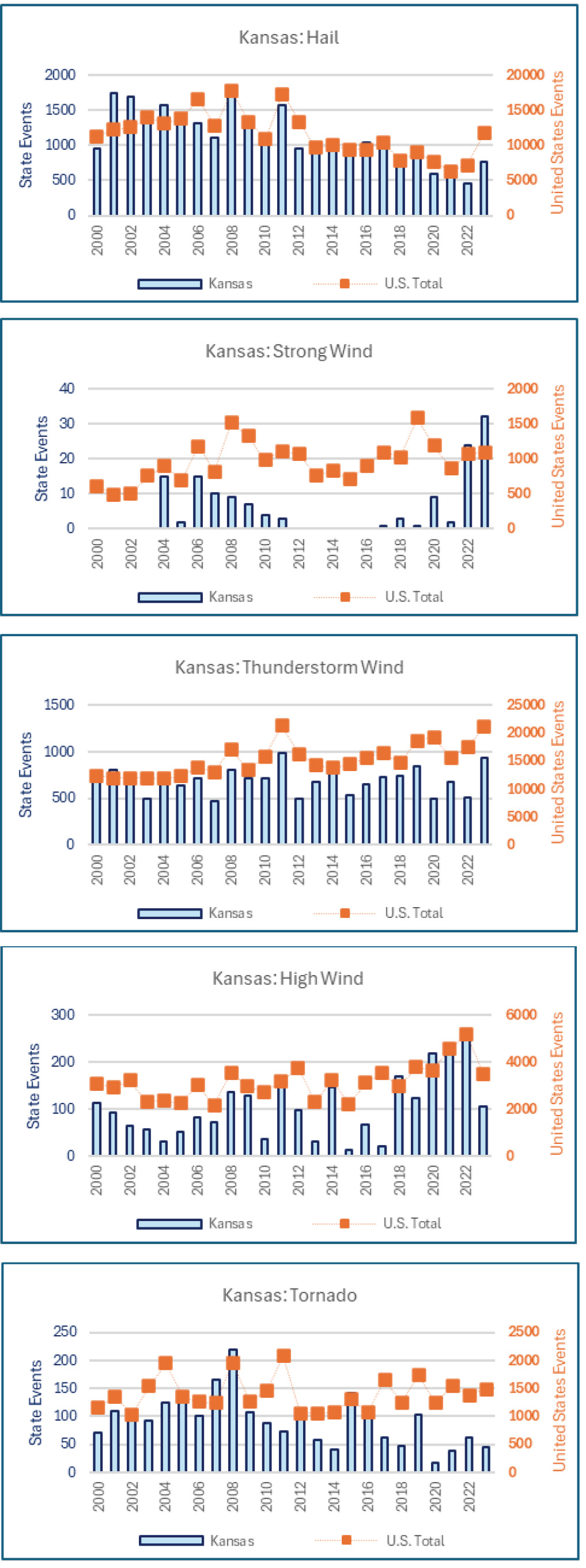

While the frequency of hail events has decreased from historical levels, the number of SEVERE hail events increased to its highest level since 2018. A severe hail event is defined as hail of 2 inches or larger. The population density where these severe hail events occur will drive the impact on insured losses. These severe hail events have a broad effect on the insurance industry because they impact multiple coverage lines, both auto and property risks, and are difficult to account for in carrier rate modeling.

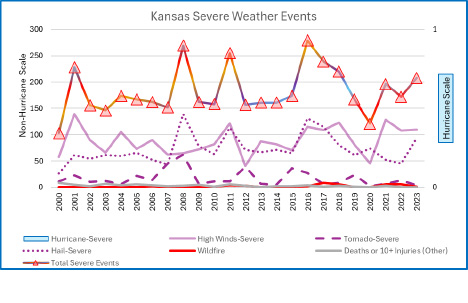

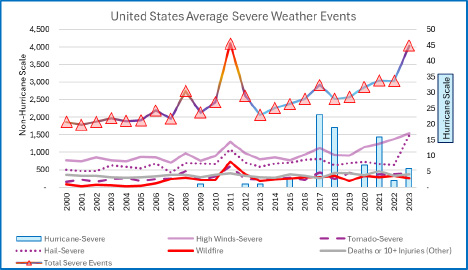

Over the last 3 or 4 years, Kansas has been rather fortunate with a relatively low frequency of tornados compared with the data over the past 20 years. However, there has been an increase in severe weather events involving wind. Carriers have their eye on an increase in wind and hail damage caused by convective storms and thunderstorms. Over the past year several years our lower frequency of tornadic activity has been replaced by damage from high winds. There has also been increase in frequency of wind events across the United States. Just like in Kansas, there has been an uptick in severe hail events from 2022 to 2023.

The big issue facing the insurance industry is the claims costs associated with replacing damaged roofs. The inflationary pressures have hit the insurance industry hard, especially for roof replacements. On the personal lines side, asphalt shingles are not necessarily designed to resist large hail combined with the higher winds we’re experiencing. In additional The Insurance Institute for Business and Home Safety has researched the durability of shingles over time and while a manufacturer may say it has a 30-year life, it has a higher likelihood of vulnerability to damage from severe weather closer to year ten of its product life. This has driven insurance carriers in Kansas to make rate and valuation adjustments to policies.

The Heat Is On

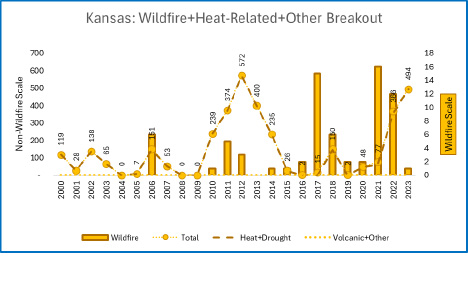

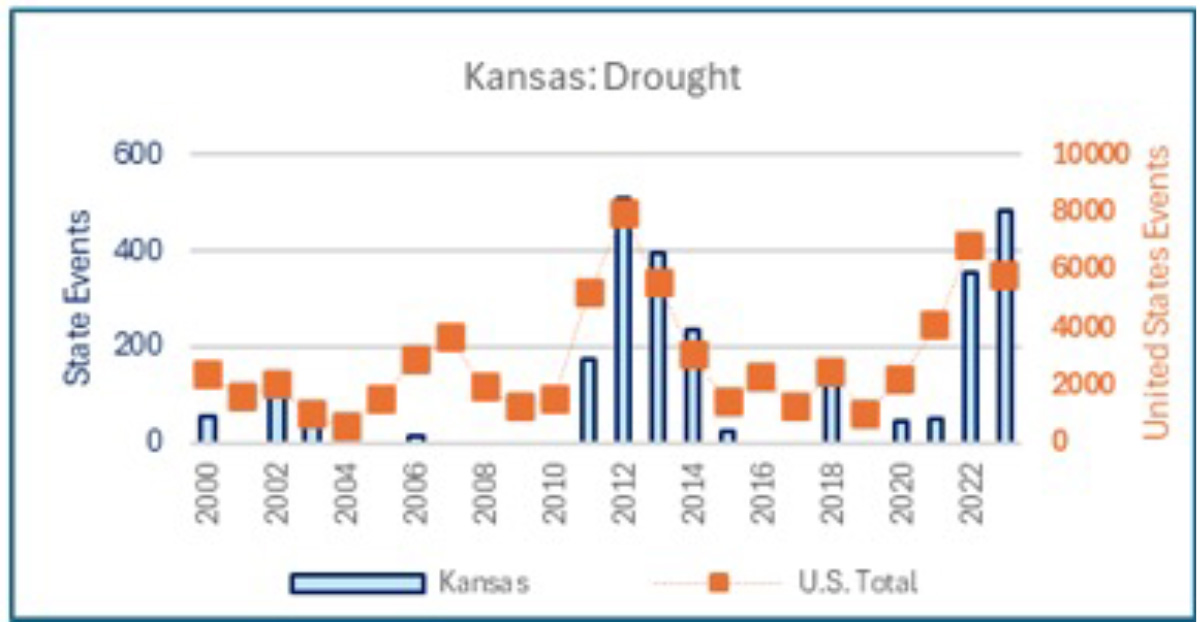

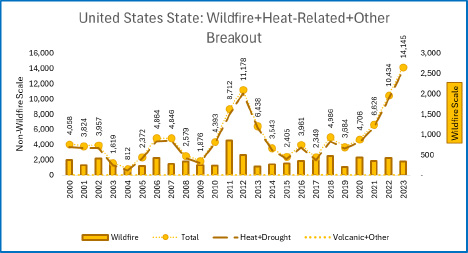

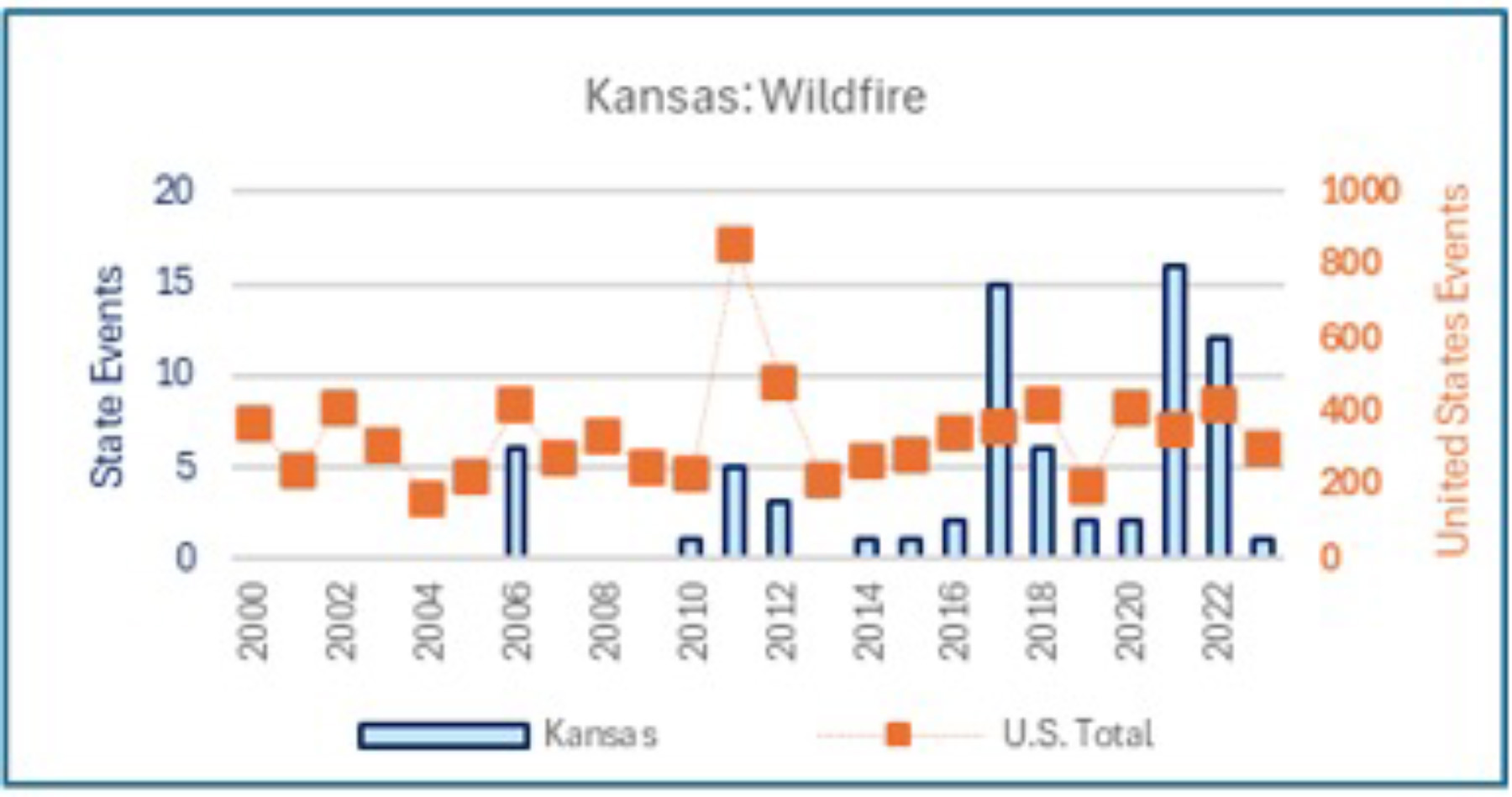

Since 2019, both Kansas and the United States have seen spikes in wildfire, drought, and excessive heat events. There were 16 wildfire events in Kansas in 2021 which is the most since 2000. Drought and excess heat events in 2022 and 2023 were the 4th and 2nd highest in the past 23 years, respectively. This has driven multi-peril crop loss ratios to over 160% the past several years which is nearly 4 times average loss ratios from 2019 -2021.

Severe Weather Trends

While the frequency of all storm events has increased over the past three years, so has the number of “severe” storm events. Severe events are characterized as winds of more than 75 mph, EF3 tornados and above, 2”-plus hail, and hurricanes above category 3. Increased frequency and severity of storm events has been challenging the profitability of the insurance industry. Add inflationary pressures for rebuilding and material costs, combined with rising liability loss costs and it is a perfect storm!

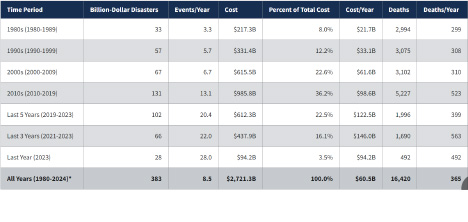

In 2023, the United States experienced 28 separate disaster events of more than $1B each with an estimated cost of $94.2B (CPI-Adjusted), according to NOAA (NCEI). This is the most events ever and is 6 more billion disaster events than the next highest year of 2020 at 22 events. The average number of annual $1B events continues to grow.

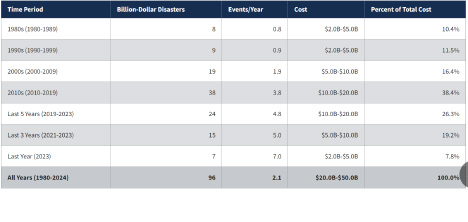

Last year, Kansas was affected by 7 separate events with total estimated costs of $1B (CPI-Adjusted). You can see that the number of these $1B events per year affecting Kansas has increased over time. Historically, April, May, and June are the most severe weather months for Kansas. According to NOAA data, in 2024 Kansas was part of two projected billion-dollar storm events. These were a winter storm in January and severe storms in March.

We hope that this information will prove helpful in sharing with your customers the impact severe weather events are having on the insurance industry. Independent agents remain the leading, trusted resource in educating consumers and providing insurance options for Kansas communities.